Simplifying Taxes, Maximizing Accuracy

We make the tax filing process seamless by ensuring every return is accurate, compliant, and optimized for your benefit.

Trust the expertise of our financial team

Our team of tax experts work together to provide tailored solutions for your unique needs. Together, we achieve your financial goals.

We provide the best tax services

Filing taxes can feel overwhelming, especially with changing IRS rules, multiple states, and complex income sources. We make the process simple, accurate, and tailored to your situation — so you avoid penalties and maximize returns.

Form 1040 – Individual Income Tax Return

Federal filing with (1) state and (1) local return included.

Schedule C Filers (Self-Employed)

Tax preparation for sole proprietors, freelancers, and small business owners.

Schedule E (≤ 3 Rentals)

Accurate reporting for landlords with up to three rental properties.

Schedule E (> 3 Rentals)

Detailed support for larger rental property portfolios.

PTP K-1 / Foreign Tax Credit Reporting

Specialized assistance with complex partnerships and international tax credits.

FBAR Reporting

Compliance with foreign bank account reporting requirements.

Additional States

Filing support for multiple state returns, tailored to your unique situation.

Expert Solutions

We assure expert solutions in order to save your money. Be it you're an individual or a business entity.

Why Choose Us

Smarter Tax Strategies, Tailored for You.

We go beyond annual filings, offering ongoing, personalized tax solutions that adapt to your changing business and personal needs.

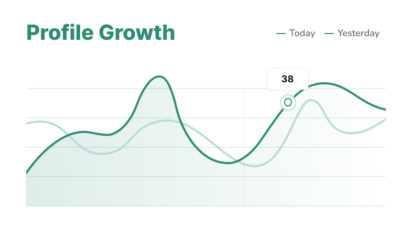

Profit Growth

Customer Care

Happy Client

The Benefits of Working With Us

- IRS-compliant and audit-ready filings

- Maximize eligible deductions and credits

- Save time and avoid costly mistakes

- Dedicated tax professionals with industry expertise

FAQ

Frequently asked questions

Yes, we manage complex multi-state filings seamlessly.

Yes, we include crypto reporting as part of Schedule D & Form 8949 prep.

We provide ongoing IRS support and representation if needed.

Tax Return Preparation

Tax Return Preparation

Tax Return Preparation

Tax Return Preparation

Tax Return Preparation

Tax Return Preparation

Tax Return Preparation