Comprehensive Partnership Income Tax Return Preparation Services

Expert partnership tax preparation for Form 1065 returns, rental real estate, special allocations, ownership changes, and multi-state filings. Maximize compliance and minimize errors.

Trust the expertise of our financial team

Our team of tax experts work together to provide tailored solutions for your unique needs. Together, we achieve your financial goals.

Strategic Partnership Tax Preparation Services

Partnership taxation is complex, especially when dealing with multiple partners, special allocations, ownership changes, and state-specific compliance. Our team ensures that your Form 1065 partnership tax return is filed accurately, while also guiding you through elections, ownership transitions, and reporting requirements. With our structured approach, you get the peace of mind that your partnership is fully compliant with IRS regulations, while minimizing risks and maximizing tax efficiency.

Form 1065, Partnership Income Tax Return – Operating Entity

Complete preparation of your Form 1065 for active operating partnerships, including one state filing and up to four partners. Ensures compliance with IRS filing requirements and accurate allocation of income, deductions, and credits.

Form 1065, Partnership Income Tax Return – Rental Real Estate Only

Tailored filing for partnerships formed solely for rental real estate activities. We handle depreciation, passive activity rules, and state-level filing for up to four partners.

Special Allocations

Support for partnerships with special allocation arrangements where profits, losses, or credits are distributed differently than ownership percentages. We ensure these allocations meet IRS requirements and are properly documented.

Ownership Change with Closing of the Books Method

Tax preparation when partners change during the year, using the closing-of-the-books method to fairly allocate income and expenses up to the date of ownership transfer.

Ownership Change without Closing of the Books Method

Alternative allocation method where ownership changes are reflected without closing the books, spreading income and expenses proportionally across the year.

754 Election with 743/734 Reporting

Preparation and filing of Section 754 election to adjust partnership asset basis upon ownership transfer, along with 743(b) and 734(b) reporting for accurate tax treatment.

Additional States (+$250 per additional state)

Filing for partnerships operating in multiple states, ensuring compliance with varying state tax requirements.

Additional Partners (>4)

Accommodating partnerships with more than four partners, including preparation of additional K-1s and allocations.

Why Choose Us

Smarter Tax Advisory, Tailored for You.

We don’t just prepare returns, we anticipate opportunities and risks before they affect you. Our advisors bring experience across industries, ensuring every decision you make is backed by data-driven strategies and current tax law insights.

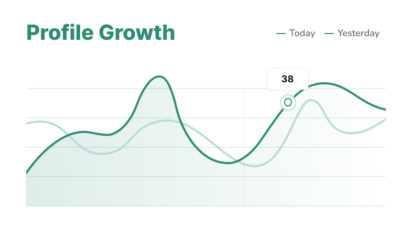

Profit Growth

Customer Care

Happy Client

The Benefits of Working with Us

- Accurate and Timely Filings

- Comprehensive Coverage

- Tailored to Partnership Needs

- IRS-Compliant Reporting

- Scalable Services

Frequently asked questions

Form 1065 is the U.S. Return of Partnership Income, required for partnerships to report income, deductions, and credits. Each partner receives a Schedule K-1 for their individual tax reporting.

An operating entity reflects active business operations, while rental real estate partnerships focus solely on property income and expenses, requiring different reporting considerations.

It divides the tax year into two segments, allocating income and expenses before and after the ownership change to ensure fairness.

A 754 election is often beneficial when a partner buys out another partner, as it adjusts the basis of partnership assets to match the new ownership interest, reducing potential tax mismatches.

The IRS imposes penalties for late filings and incorrect K-1 reporting. Each month of delay can result in per-partner penalties, making timely and accurate filing critical.

Partnership Income Tax Return Preparation Services

Partnership Income Tax Return Preparation Services

Partnership Income Tax Return Preparation Services

Partnership Income Tax Return Preparation Services

Partnership Income Tax Return Preparation Services

Partnership Income Tax Return Preparation Services

Partnership Income Tax Return Preparation Services

adgrow360.com